As the year comes to a close, Torkvia reviewed the latest available global auto sales data to assess how the competitive landscape is evolving. While full Q4 2025 results will only be available in January–February 2026, the existing data already provides a clear picture of current structural shifts in the industry.

H1 2025 Snapshot: A Ranking That Signals Change

We began with the H1 2025 rankings from Visual Capitalist (“Ranked: The World’s Best-Selling Car Brands”), authored by Niccolò Conte with data from Felipe Munoz. The global top five automakers by unit sales are Toyota Motor Corporation, Volkswagen, Ford Motor Company, BYD, and Hyundai Motor Company. A notable takeaway from this ranking is that BYD has moved ahead of Hyundai and Honda, a shift that would have seemed unlikely just a few years ago.

Data Limitations and Methodology

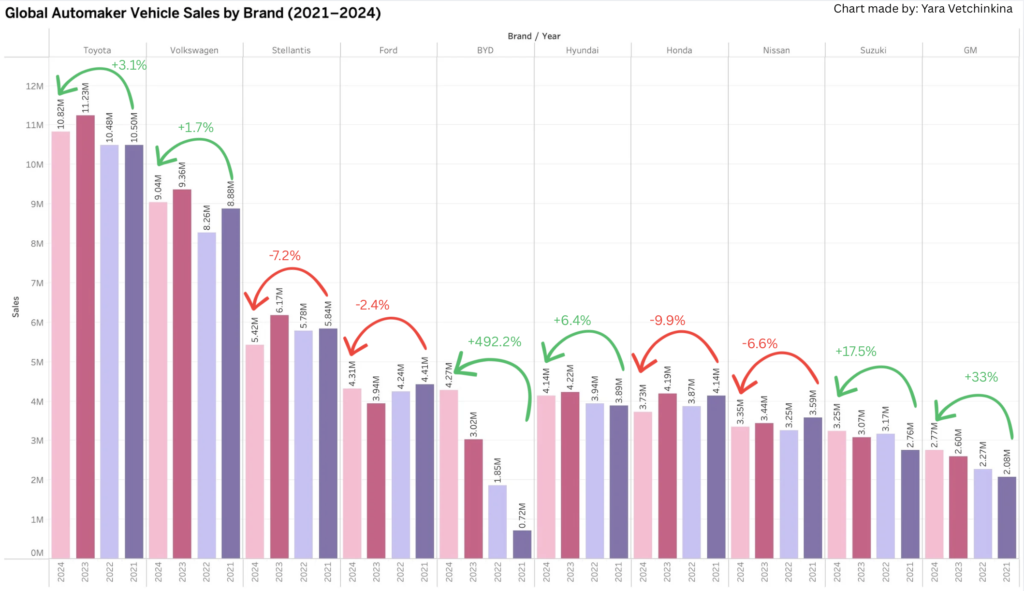

This prompted a deeper review of global vehicle sales for the top 10 automakers from 2021 through 2024. It is worth noting that consistent, comparable global sales data is difficult to source, so this analysis relies on official company press releases.

The Incumbent Leaders: Toyota and Volkswagen

At the top of the market, Toyota and Volkswagen remain the clear global leaders, selling approximately 10–11 million and around 9 million vehicles per year, respectively. Although both experienced modest declines in the most recent year (roughly –2–3%), the scale gap between these two groups and the rest of the industry remains substantial.

Mid-Tier Pressure: Stellantis and For

Further down the ranking, performance begins to diverge. Stellantis and Ford both show declines of approximately –7% and –2–3%, respectively. Multiple factors contribute to this trend, including weaker EV competitiveness and declining influence in Europe under increasing pressure from Chinese manufacturers. While Ford’s truck lineup continues to dominate the US market, this analysis reflects global performance, where Ford’s position is less pronounced.

BYD’s Growth Trajectory: A Structural Shift

The most significant structural change is evident in BYD’s growth trajectory. Global sales increased from approximately 0.7 million units in 2021 to around 4.3 million units in 2024, representing roughly 479% growth over three years. Torkvia’s projection for 2025 is approximately 4-4.5 million units, not due to weakening demand, but because the Chinese market is becoming increasingly saturated, with domestic brands intensifying competition among themselves. Even within this environment, BYD has established a strong and durable global footprint.

Global Footprint: Why BYD Is Different

Unlike Lucid and Rivian, which remain largely concentrated in the US market, BYD operates across the Middle East, Europe, Russia, most of Asia, and additional regions. Its combination of scale, pricing, and geographic reach presents a growing challenge for legacy OEMs.

Looking Ahead: China’s Expanding Share

Earlier forecasts from 2024 suggested that Chinese automakers could account for approximately 33% of global market share by 2030. By June 2025, BYD alone captured 31.7% of China’s EV market, while Tesla held 5.5%, ranking fourth. These figures highlight the widening gap within the EV landscape.

2026 Outlook: Adaptation Over Brand Power

These trends must be viewed within the broader context of 2025, a year marked by heightened volatility driven by tariffs, geopolitical pressures, and the gradual rollback of subsidy programs. 2026 is likely to be a defining year, separating manufacturers that successfully adapted their scale, cost structure, and geographic strategy from those that relied primarily on brand strength.